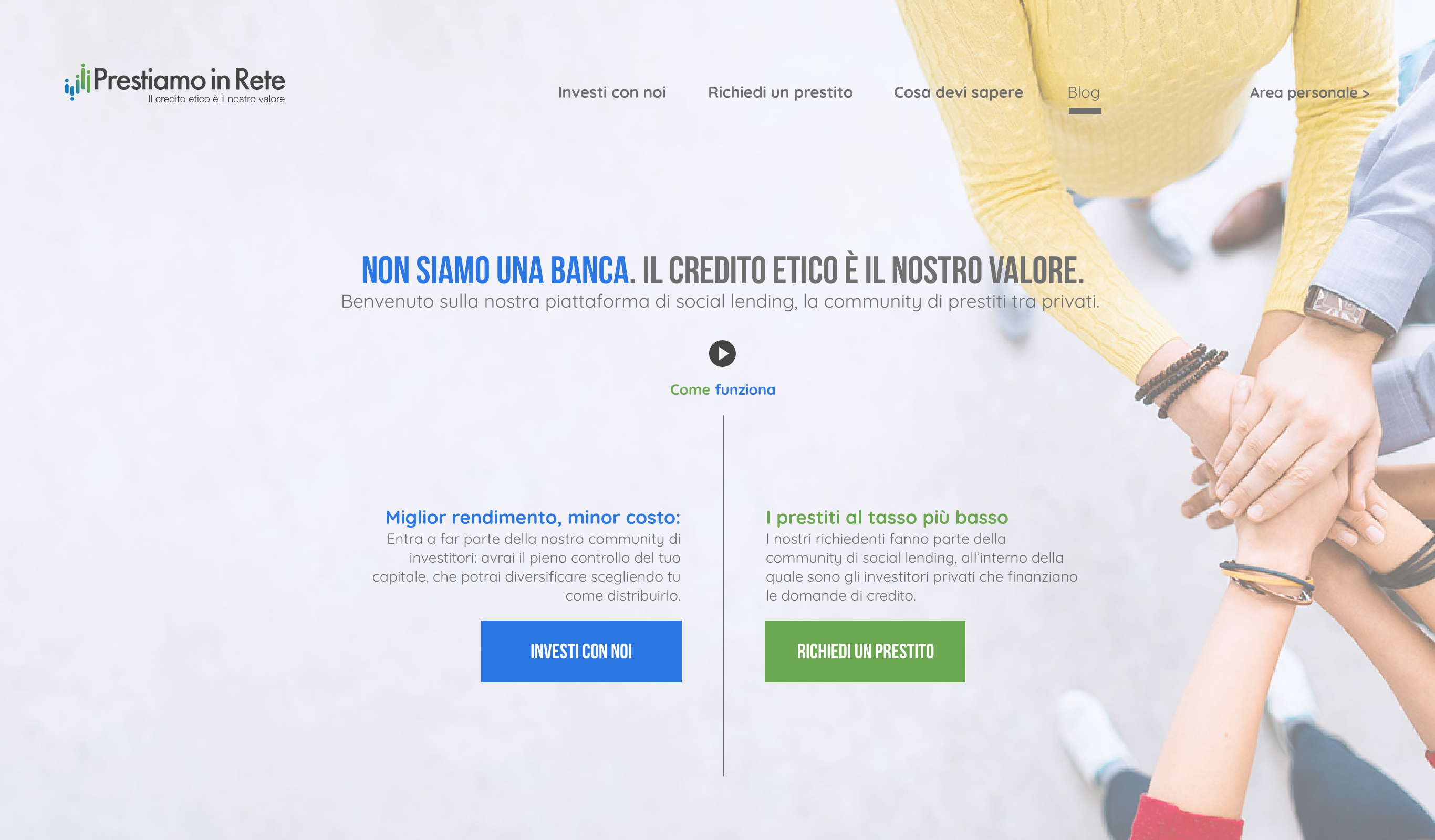

Peer to Peer Lending Platform

case 1.

Prestiamo In Rete is a social lending platform emerged from the joint effort of a group of entrepreneurs specialized in various business sectors.The idea of creating a solid structure that could support and guide private individuals engaging in independent financial activities has been the inspiration for this project.

In a fast growing market like the one related to Peer-to-Peer networks, the need for a clear differentiation interme of ease of use, content clarity, information architecture, and customer journey represents a necessary challenge to overcome in order to acquire authority in a sector that is still dominated by suspicion and mistrust towards this business model.

Being able to communicate the necessary sense of authority in a complex market often associated with the banking sector and therefore the target of mistrust and prejudice;

Developing an information architecture that can speak equally to both potential investors and potential borrowers;

Designing an interface that is extremely easy to use and understand in a business sector that is still relatively unknown in Italy.

1 Project Manager

2 Ux Designers

2 Front end Developers

1 Back end Developer

1 Seo Copywriter

Given what I knew about the Italian social lending market, I conducted an initial analysis of competitors, their business choices and their most valuable contributions.

I subsequently planned a two-step process with interviews and a focus group:

Discovery phase

Stakeholders

Hidden Stackholders

Organizational and financial managers

Corporate vision

Business model specifications

Project requirements

Some of the main questions asked during the initial interview phase.

___

Are all stakeholders in agreement regarding the project’s objectives or do they have contrasting ideas?

___

How do they perceive their role in the success of the project?

___

What work has already been done and what needs to be started from scratch?

___

Do I have all the necessary information on the project?

___

In terms of this project, what does long-term success look like for each stakeholder?

___

Why are we creating this product?

___

What user needs would you like to fulfill with this project?

___

Cosa sappiamo delle preferenze dei nostri utenti riguardo a questo prodotto e allo stesso modo di cosa non siamo ancora sicuri?

___

What do we already know about the preferences of our users in regard to this product and what are we not yet sure of?

Companies with no ties to the traditional banking sector, responsible for generating an overall sense of mistrust

Convenience (commissions / revenues)

Community spirit

Relatively unknown business model

Initial mistrust

Several competitors have already received authorization from the Bank of Italy

Well before conducting any research, we had to organize a series of workshops with the stakeholders, which provided us with our first proto personas.

It is important to understand that Prestiamo in Rete required substantial research that targeted two groups: Investors and potential borrowers.

Thanks to the partnership with an additional Ux Researcher we began initial exploration, targeting investors first.

Below I am reporting the investor-related results of our research.

Goals

What level of awareness users have about their financial health.

What they can do to improve their financial health.

How much they know about Social Lending.

Methodology

Qualitative and quantitative research.

Ten interviews and a survey involving a sample of 120 users.

Intuition

From the very beginning, it became apparent that most of the interviewed subjects had little knowledge of the business model related to Peer-to-Peer Lending networks.

Quantitative outcomes

+75%

although interested in improving their financial health, had no idea how to go about it;

+80%

ignored what Social Lending is;

+40%

would have liked to invest, even if just small amounts, if they had felt more transparency, confidence, and clear communication. That is why having a dedicated consultant to answer questions is essential.

Below is one of the two individuals identified as personas:

Assistant Manager. Michael is a young engineer, who has been working as a consultant for several years.Thanks to his professional dedication and the skills acquired on the job, he had the opportunity to work for several multinational corporations with increasingly higher positions.Given his careful planning of every aspect of his life, he wanted to learn more about the investment world.

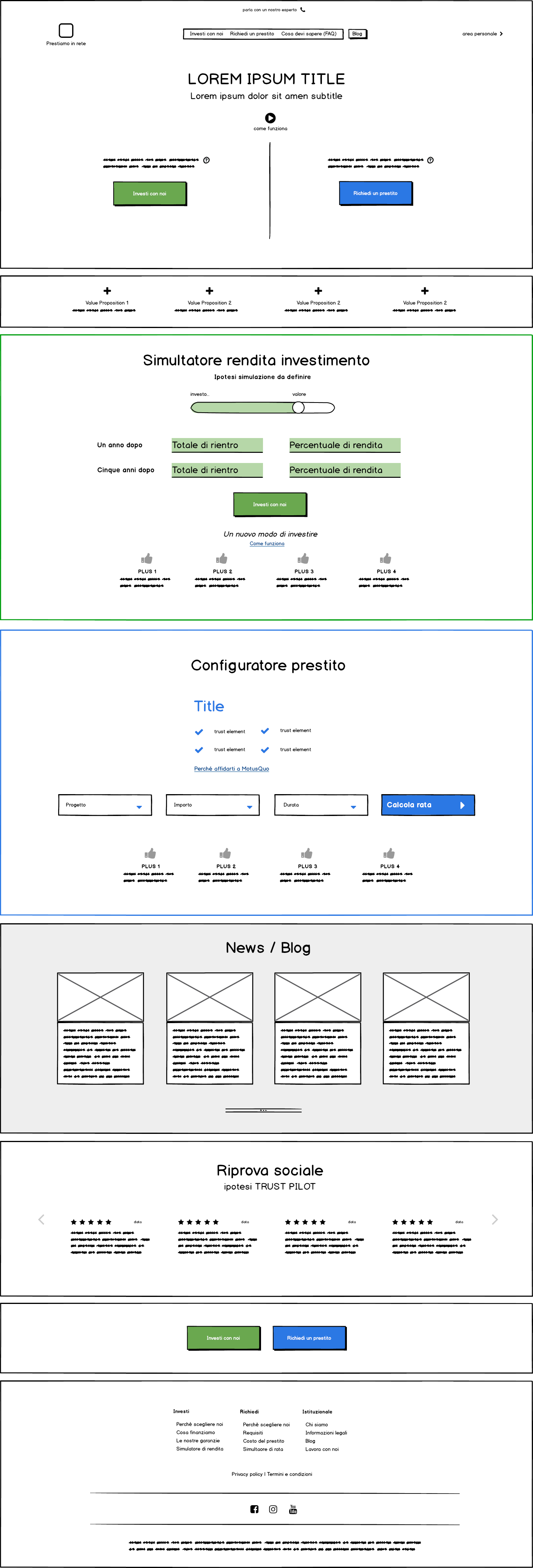

The main pages of the “Invest with Us” and “Request a Loan” services have been designed as a landing page.

The Main Menu will still focus on the two main services offered, according to the following grouping:

By using the hover selector, the secondary entries designed to provide further information will redirect the user to specific sections within the page itself.

This business model entails two main players: investors and potential borrowers.

From the very beginning, one of our main issues was the creation of accounts that would let users manage their active services.

From the initial idea of dividing the account creation process based on the selected service, we ended up coming up with a different solution.It is a consolidated process for which I am reporting one of the main flows, summarized for practical and legibility reasons.

User Flow Sign-in / Sign-up

The first wireframe relates to the homepage and is the result of thorough analysis and prior discussions among the parties.

The sections dedicated to investors and borrowers, with all related configurators, acquire greater relevance here.

From the analysis, discovery, and discussion phases, we arrived at the first high-fidelity prototype representing the homepage.

To create it, we chose Adobe XD.

The project proved to be quite complex due to the nature of the business model, still relatively unknown in Italy. The greatest challenge was defining value propositions in a clear, simple and transparent way.

The financing sector has in fact been the target of widespread mistrust that is difficult to eradicate. Stakeholder involvement allowed us to employ Proto Personas that proved useful in the initial phases and in identifying the clusters of users we were designing for. People often tend to often bypass using them, when they can actually be extremely helpful in formulating initial hypotheses, especially when co-designing activities involve a non-technical audience.

This is a project that still has a lot to tell and because of its own nature, it is constantly evolving.